Taxation of Pension Benefits in Retirement – A Guide to the Advantages

Tax and pension benefits in one headline! If I still have your attention, do not worry, as this is a good news article with valuable information that will benefit you in retirement and give you peace of mind now.

Taxation of Pension Benefits

As part of our advice process, we offer full cashflow modelling that runs your financial future out to the end of life, and this factors in the tax you pay on your income in retirement.

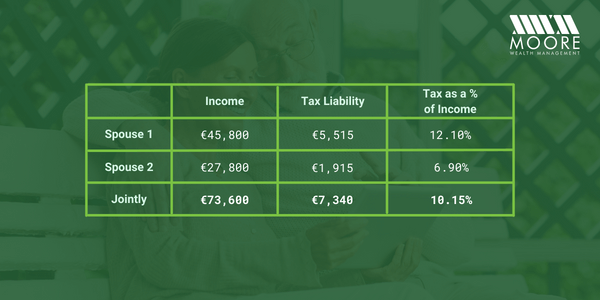

So, the first thing to clear up is that you do pay tax on your retirement income, including the state pension, but the good news is that there are very generous allowances from revenue and with the proper advice and planning, you can have an income of €73,600 per annum at an effective income tax rate of 10.15%

State Pension -Your Entitlement

The State Pension (Contributory) entitlement of an individual is calculated on their PRSI record and is then assessed under two methods (Yearly Averaging & Total Contributions Approach), with the individual’s entitlement being based on whichever provides the best outcome.

In both cases, it is a requirement that the individual has paid at least 10 years’ worth of PRSI. If you are unaware of your PRSI record, you can request this from your own www.mywelfare.ie login, and this is something you need to know.

For a married couple with full entitlement, this amounts to €26,343 per annum. If you wanted to buy that income in the open market via an annuity, it would cost in the region of €700,000, so you can see the value of this.

Lump Sums

The first major advantage of having a pension is the entitlement to a tax-free lump sum on retirement up to revenue limits.

Currently, you can take up to €200,000 completely tax-free, and depending on your fund size and needs, you can take the next €300,000 at a tax rate of 20%. If you combine both, you can extract €500,000, which was an initially tax-relieved contribution from your business, into your hands at an effective rate of 12% which is less than the tax relief you obtained, thus making it a near-tax-neutral transaction.

While it is rare to see someone extract this much at retirement with the excellent post-retirement options available, it is still a choice.

Where someone makes a lump sum contribution into their pension near to business exit/sale to extract cash (as no buyer is looking to purchase cash), the tax relief will have two treatments depending on several factors.

Some will be offset in the year of the contribution, thus reducing the corporation tax liability, and what is less well-known is that some can be carried forward in the company as an asset that is factored into the sale of the business.

Post Retirement

The balance of funds after the tax-free cash option, in many cases, goes into an Approved Retirement Fund (ARF). This is an extension of your pension planning that allows your accumulated funds to continue to grow tax-free and is drawn down as your needs dictate.

To make sure that the funds do not sit indefinitely in your ARF, Revenue taxes these under a practice known as Imputed Distribution. This means that from your 60th birthday onward, they tax you under the assumption you have taken 4% of the fund from your ARF, so you should make a withdrawal of at least this amount. From age 70 onwards, this increases to 5%.

Planning Opportunity

The fact that you need to extract 4% from your fund can be used for those who retire early and will not have another source of income, who wish to continue to accumulate PRSI credits for the state contributory pension and the valuable benefit outlined above.

To ensure that a PRSI record accrues towards the State Pension (contributory), a withdrawal of at least €5,000 in the relevant year would be required. That €5,000 withdrawal can be taken monthly, quarterly, half-yearly, or as a single payment.

In all cases where the total withdrawal or withdrawals equal or exceed €5,000, then the individual will accrue 52 Class S PRSI contributions, which are essentially a full year’s worth of PRSI contributions.

This is a different approach to that of a standard private sector employee who would pay Class A PRSI and would only receive one Class A contribution for each week of work. Therefore, one ARF withdrawal of €5,000 or more will accrue 52 weeks’ worth of a PRSI record, which would take a private sector worker a full year of working to match. Again, this is vital information in your retirement planning.

Taxing your Income

With an ARF, the plan is that you draw income from this in retirement to fund your lifestyle. As you do this, you are looking at two things: The level of withdrawals that you hope can be sustained from investment performance and the level of tax you pay when combined with any other income.

You want to keep your taxation level as low as possible.

Allowances

Between the personal, employee, and aged tax credits, a married couple will have €5,345 credits on top of an exemption from income tax that goes up to €36,000, which can give you marginal relief up to €73,600.

The best way to illustrate this is with an example where we will take a couple where one spouse is age 66 and there are two pension funds with values of €1.08m and €480k, respectively.

What you will see above is that a couple can earn up to €73,600 in retirement at an effective tax rate of 10.15% when you factor in all allowances and credits.

While this is an illustration of ARF incom,e this could also be a combination of state pension, rental income, and ARF withdrawals.

In our view, this is a very strong case for funding your pension for retirement living and dispels the notion we hear about the effects of tax in retirement. Bear in mind that the income you are drawing down has accumulated and grown in the most benign and favourable tax environment that exists for investors in Ireland.

If the above example consists only of income from your ARF, you will also have benefited from two sizeable tax-free lump sums from your pension of circa €380,000.

USC and PRSI

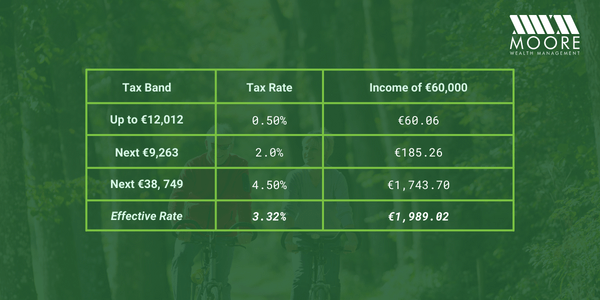

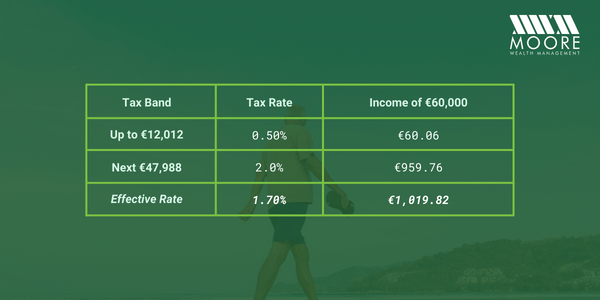

You must however, add USC to the above tax computations, but again, this is a benign rate in the age ranges below.

Age 66 to 70

Age 70+

An important point to note is that you cease PRSI contributions once you reach 66.

How Do We Work this into Our Advice?

We can run this backwards to your current starting position and see what level of pension funding you need to make now at conservative growth assumptions to get to, for example, the scenario above.

By combining this with cashflow modelling, which gives you an accurate picture of your financial future, you can then invest with the appropriate amount of risk to achieve your goals. Our process is bespoke and comprehensive.

Important Update on Company Paid Pensions Changes

There have been significant changes to the typical pension a company director in Ireland operated.

The Pensions Authority shut off new access to these schemes, and as yet, we do not have a viable alternative. This means anyone who currently has one of these schemes has in their retirement planning armoury a supremely efficient vehicle for cash extraction and wealth accumulation that a growing number of people wish they had. I

f you have not maximised the opportunities this pension gives you, it is in your best interest to have a consultation with a suitably qualified person to explain this opportunity while the option still exists.

*Please note that all the above is subject to current tax rates, and Budget 2023 has made the scenarios outlined above more favourable with the widening of tax bands. This should not be taken as tax advice, and you should always engage the services of your accountant and/or tax advisor when making your tax return.

Colm Moore is a CERTIFIED FINANCIAL PLANNER™ with Moore Wealth Management.

MWM has been advising pharmacists for over 20 years. For more, see www.mwm.ie.

Check out some of our other articles here and follow us on LinkedIn for more great content.