Preserving the REAL value of your money

Preserving the REAL value of your money

It is safe to say one of the most common questions I get asked as an advisor is “what should I do with surplus funds that are sitting in a bank account that can provide a return but are also low risk?”

With the aim of answering this question, we must look at a few issues:

- What is risk?

- What is the real value of money over time?

- What are your options?

- What is happening with stock markets?

Let us start with some context for where markets are right now

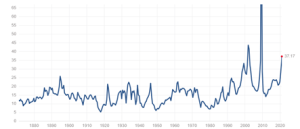

Stock markets are at the near record levels that preceded recent corrections. When looking at investing in the stock market a common metric for value is the Price Earning (PE) Ratio. This is the amount you pay for 1 unit of future earnings. Long term averages are in the region of 14 but today the main index of US stocks is trading at 37.1. Think of it in terms of buying a new pharmacy, how many years earnings are you willing to pay the current owner for the business. At a PE of 14 you are paying 14 years earnings to own the new business. Then think about a PE of 37.1 and while thinking about that consider that Tesla is trading at a ratio 1,213 in Dec 20. It would be easy to believe that there is now a disconnect between reality and investor sentiment. This is partially driven by poor inflation beating alternatives to equities.

S&P 500 PE Ratio:

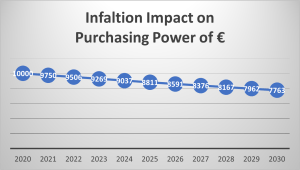

You will see from the chart that these PE ratios are way above historical norms and this presents challenges for both the investor and adviser. Looking at other alternatives clients are then drawn to bonds and often cash, however both these are asset classes that are currently yielding negative and low returns. This presents a difficult climate for those looking to avoid the impact of inflation and negative interest rates on cash which cannot be underestimated as per the chart below showing the erosion in value of €10,000 over 10 years. The stark reality is that almost 25% of your money will have been lost in real terms and this too is a risk that needs to be considered.

According to the Central Bank’s latest Money and Banking Statistics for October, the outstanding amount of household deposits now stands at €123 billion. The figure for non-financial corporations is €70 billion. Deposits by households increased by €1.7 billion in October – an increase of 11.7% or €12.6 billion in a year – the highest annual increase on record.

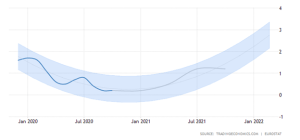

These are staggering numbers and exaggerated by the closure of retail options and the caution that comes with possible financial uncertainty. Yes, everyone should have a rainy-day fund equal to approximately 3 months earnings in near to liquid form. Once that is covered consideration must be given to the erosive impact of inflation and inaction. Yes, inflation has been historically low recently but as you can see below it is predicted to trend upwards again over the next year and into the future.

What is an investor to do?

The first step is to identify what is surplus to near term requirements. This means making sure you have the following done first

- Pay off any high interest liabilities such as credit card debt and car loans

- Have a qualified adviser run analysis of the impact of overpaying your mortgage to shorten the term. The savings here can be quite significant

- Make sure you are maximising what pension contributions you can make as the tax advantages of pension saving are well known.

Once you have analysed this you will end up with typically two scenarios.

- Surplus monthly income after outgoings that can be directed to regular savings

- A lump sum amount that you can tie up for a 5 to 10 – year period.

We recently discussed the advantages of euro cost averaging and paying money into savings contracts on a regular basis to buy into both the highs and lows of markets fluctuations. This offers another layer of protection to investors as all your funds are not hitting the market at one point. By using this methodology and investing in a fund with a historical strong track record over a 5 year plus period you are looking at producing a return that beats the impact of inflation. As always, it is not about “timing the market” it’s about “time in the market” with a savings contract optimised to give you every advantage you can to generate a return.

The Best way to help your children.

I was asked recently what the best piece of investment advice I could give a client who wants to accumulate funds to pass to his children. I believe the client was looking for a stock selection or an investment manager recommendation. I told him the best long term return he could offer his child was a targeted fund that looked to provide the child with the funds to pay for the deposit on a new home. We have the strictest lending requirements in Europe, a scarcity of housing, rising prices and high deposit requirements pricing young buyers out of the market. This means home ownership for a generation is becoming harder to achieve. Only 10% of new builds fell within the affordability level of the average salary requirements at 3.5 times earnings in recent years in Dublin. The financial cost of not owning your own home over a lifetime is significant. Those who own their own homes are shown to be in the region of €800,000 in net worth better off than those who cannot afford a home by virtue of owning the asset and not paying rent to a third party. By making sure you child can get on the housing ladder you are contributing significantly to their lifetime wealth.

Further Planning around Wealth transfer and tax optimisation

If you are in the scenario where your adviser has quantified that you already have sufficient assets to recreate the lifestyle you need to the end of your life you can begin to pass assets onto your children. You do have to be mindful of the Capital Acquisition Taxes (CAT). Once you go over the gift/inheritance tax threshold currently at €335,000 your children face a tax bill of 33% on the surplus. When you factor in the value of your business, family home along with pensions and investments it quite easy to see a scenario where this becomes a problem at some point. A practical solution to both accumulating savings and addressing the capital taxes issue is to have the savings policy endorsed under section 73 of the tax code. This means that if you keep the policy in force for 8 years the proceeds acquire a special status with revenue where you can use the policy to pay the CAT tax liability

Imagine a scenario where you decide to gift a property valued €500,000 to a child in 8 years’ time.

| Total gift | €500,000 |

| Tax free threshold | €335,000 (assuming no previous gifts/inheritances received) |

| Taxable gift | €165,000 |

| Taxable at 33% | €54,450 or nearly 11% of the value of the gift taken in tax. |

Therefore, if you gift your child the property, they will lose up to 11% of the value of the gift as they will have to pay €54,450 in gift tax. However, to fund for this tax, you can use the proceeds of a section 73 savings plan. This is then used to clear the gift tax bill without further adding to the issue. If you had just given €54,450 from your bank account, this would have just increased the gift tax bill by an additional 33% of that amount. To endorse a policy under this revenue status is simple and the policy does not have to be used for this purpose, but it does give you the option.

Another alternative where you could help give your children a foot on the property ladder without eating into their tax-free gift threshold is to set up savings plans in their name and use the annual gift tax exemption of €3,000 per parent per child to fund the savings. This is an annual gift allowance that if not used each year is lost and it can be a vital (if underused) component of tax efficient wealth transfer. Take an example of a 15-year-old child where the parents are transferring the full €6,000 per year into a savings plan for 10 years. At age 25 this child may have the earning potential to repay a mortgage but would never have the deposit required. A policy like this should be worth circa €80,000 at this stage and these savings would be in their name so they face no taxation on accessing funds.

If you tried gifting the €80,000 to them at age 25 for the deposit it will come off their threshold and reduce it to €255,000 (assuming no further changes) and ultimately for larger estates, this will result on 33% of the €80,000 being lost eventually. This is a relatively simple way of avoiding a loss to your estate of €26,400 based on the example above while reducing the time it might take your child to get their own home.

Solution for Companies

Many corporates are looking for a home for surplus cash to avoid the close company surcharge. This is a tax of 20% on undistributed income. If you do nothing you lose 20% of the accumulated funds. This added to the erosive effect of inflation is not an acceptable scenario and again after you have been advised to maximise your options for pension contributions you can look at investment options here to avoid this tax. We will deal with this issue more comprehensively in a future article on how best to deal with Corporate cash

Beating inflation with the only Asset class than can and does for every rolling 10-year period on record

Equities are the only long-term inflation proofing asset class over the medium to longer term, this is borne out by the historical records tracking both historical equity performance and inflation. Yes, equities can be volatile in the shorter term, but they always work when you allow time in the market. Time is the ingredient that dramatically reduces risk, and you can benefit from Euro cost averaging on regular savings (buying more units at lower prices when stocks fall) and or lump sum investors there is no ten-year period when you would not have beaten inflation going back 100 years.

In summary we can conclude that when looking at surplus cash in the medium to longer term there are in fact two risks to be considered

The risk of inaction – this causes a dramatic loss of the value of your money in real terms over time as inflation outpaces deposit style returns

The Investment risk – yes there are of course risks associated with investing in equities but importantly these can be significantly reduced if you allow equity markets to do what they do over 5 year plus time frames and use regular monthly savings to benefit from Euro cost averaging.

In this context the historical data tells us that the lesser risk is putting these funds to work in the medium to long term.