Colm Moore for Irish Pharmacy News ‘Auto Enrolment is Coming Soon – We Think!’

Our managing director Colm Moore recently gave a detailed, yet simplistic overview of the oncoming rollout of the Auto Enrolment Pension Scheme and everything you need to know about the upcoming initiative in the latest publication of Irish Pharmacy News.

Take a read of the full article on the digital copy of the Irish Pharmacy News Publication here.

The Key Points to Note About the Auto Enrolment Pension Scheme

Where Did The Idea To Run The Auto Enrolment Pension Scheme Come From?

The Auto Enrolment Pension Scheme is an initiative created by the Government in Ireland to help individuals reduce their reliance on the State pension upon retirement.

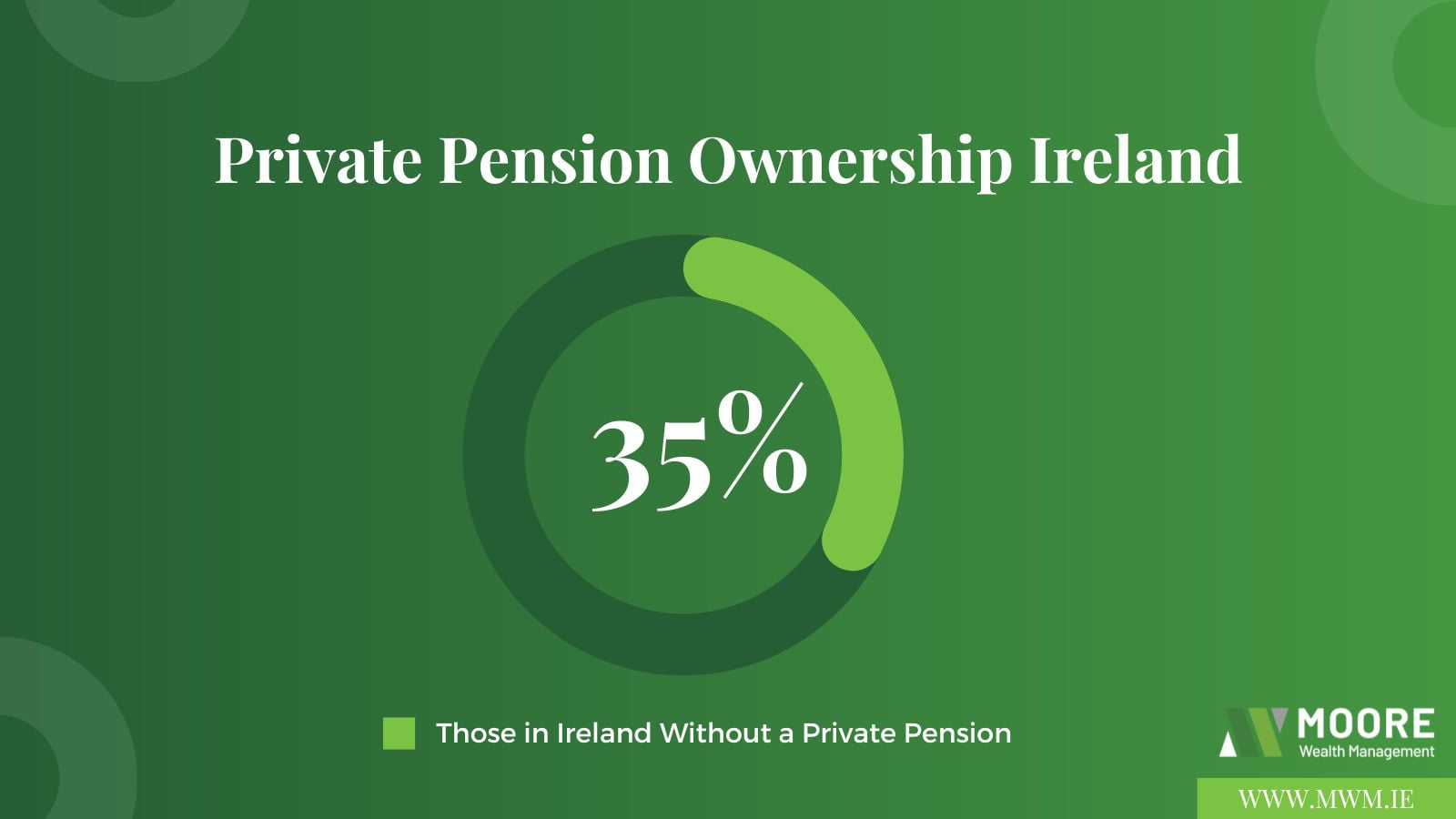

Some of the latest insights by the CSO reveal a staggering 35% of people in Ireland have no private pension.

This scheme will aim to tackle this issue and provide workers with access to a better pension plan for their retirement.

Eligibility For The Scheme

- Aged between 23 and 60.

- Earn over €20,000.

- Not enrolled in an occupational pension scheme, qualifying PRSA or qualifying trust RAC – with an employer making contributions.

Exemptions To The Scheme

- Employment where the employer already pays into a pension scheme for the employee qualifies.

- Other exemptions may apply – pending publication of standards.

Opting Out

- The Auto Enrolment Pension Scheme will work on an ‘Opt-Out’ principle – you will be automatically enrolled unless you declare otherwise.

- After being enrolled, you have to remain in the scheme for 6 months before opting out.

- Opting out can happen after 6 months but no more than 8 months after enrolment.

- Opt-out windows will continue to occur periodically throughout the lifetime of the scheme.

- People won’t need to re-enroll if they’ve reached retirement age or are contributing to a pension that meets the Authority’s upcoming standards.

What Will It Cost To Be Involved?

- Employers and employees make matching contributions.

- The State will put in one-third of a contribution – less than that of current tax relief given on employee contributions in the 40% tax bracket.

Your Choice Of Funds

- 4 funds with varying levels of risk.

- Likely to land in wrong fund with lack of information and advisory services around Auto Enrolment Scheme.

Changing Jobs

- You won’t need to change/move to a new scheme if you switch jobs – ‘Pot-follows-the-member’ principle

Does Your Employer Have to Partake?

- In short – yes.

- Penalties, prosecution and repayments with interest could be incurred where an employer doesn’t make contributions.

Actions For Employers

- Guides will become available as we approach the scheme going live.

Employer Tax Relief

- You can claim relief on your contribution, but not your employees.

Enrolment For Owners/Directors

- Your enrolment will depend on PRSI.

- If you are paying PRSI as an employee, you will be enrolled.

- If you are registered as self-employed, you will not.

Returns To Be Made By Employers

- Separate returns will need to be made through payroll to the central body.

- More information will be made available on this.

- Calculations will be made via payroll software system.

Can Anything Be Done Now?

- For employers – budgeting will be key.

- Employers also need to be aware of employees that may be enrolled in the scheme – particularly where you may have a waiting time for joining an internal pension scheme, as employees may be enrolled in the Auto Enrolment scheme in this time.

- Otherwise, there are still a number of concerns with the scheme that could see a 2026 start, rather than the predicted 2025 launch.

Auto Enrolment Process Walkthrough

- Eligible employees are identified through Revenue data with no waiting period for employees

- Payroll notification will be sent via payroll software and the employer will apply payroll notification

- Contributions based on gross pay collected from employer and employee

- Contributions are invested on behalf of employees

- Pots will follow employees across jobs through their working life

If you are an employer or an employee who needs guidance or support on Retirement or Pension Planning or the Auto Enrolment Pension Scheme, contact us today.

Follow us on LinkedIn to keep informed on industry insights, updates and our latest news.