Longevity: The Underappreciated Retirement Risk

There are two distinct stages in an investor’s financial planning lifetime.

The first requires them to squirrel away money for the future, hoping to benefit from the magic of compounding returns. We call this the “savings stage”.

At retirement, the investor transitions to the “spending stage” of life. From this point, they will withdraw from, rather than continue adding to, their investment portfolio. While any habit of frugality they developed during their life will continue to be beneficial, this major change in direction can be a difficult adjustment.

In this phase of life, we’ve identified two risks facing the retired investor: one risk we believe they fear a little too much, and the other risk we see them fear not enough. We’ll unpack both risks and highlight why the one deserves more attention.

Retirement Risks

The Eternal Fear – Volatility

Like the pre-retirement investor, retirees also have an innate fear of market declines. These are periods when market prices decline, often due to a global crisis or worsening economic fundamentals.

The technical term this has become known by is “volatility” – the erratic fluctuations of market values around a typically rising baseline. In essence, the takeaway for the investor is that while the market has historically risen, it does so not in a straight line.

The fear for the retiree is that while the market is experiencing a temporary decline, they will need to sell investment units at a lower price to fund their living expenses. This, all other things being equal, does have an impact on the expected lifetime of their assets. It’s a factor that should be considered, but it can also be planned for.

For example, many retired investors retain a lump sum in cash, from which they can make income drawings during times of market decline.

The reality is that temporary declines happen regularly without warning. The best way to earn the full market returns is to endure these periods with patience and discipline. By planning properly, we can essentially shield an investor from permanent damage happening from temporary declines.

The Underappreciated Fear – Longevity

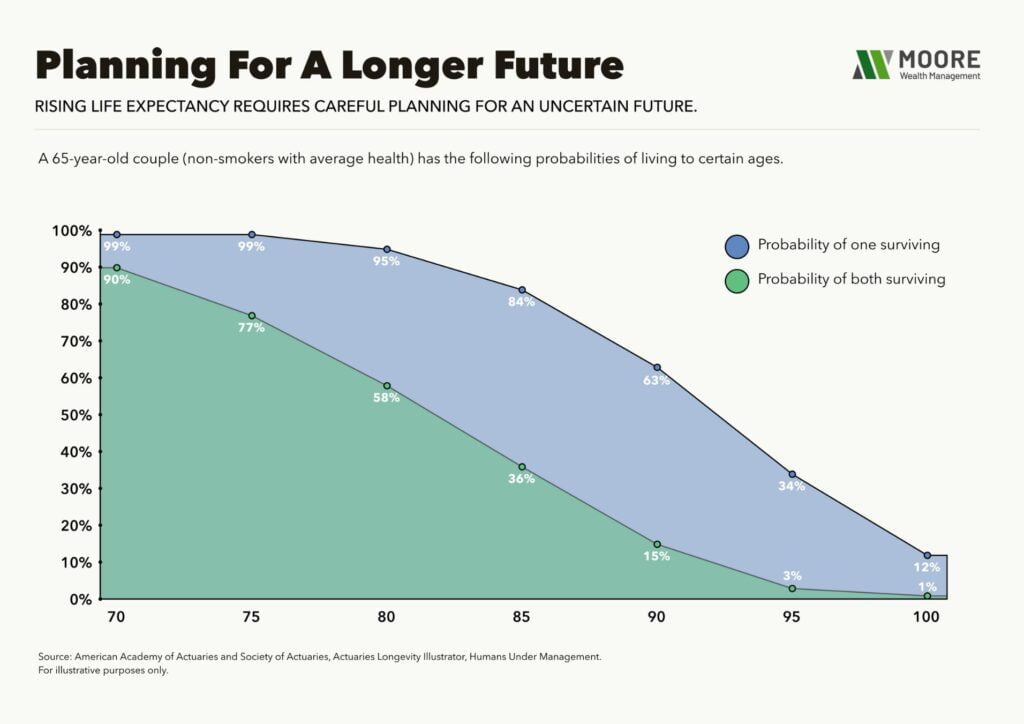

Over the last few decades, the average investor’s life expectancy has significantly increased. A few generations ago, it was rare for a retiree to live for longer than fifteen years while relying on their investment assets. Today, thanks to advancements in medical care, diets, and healthier lifestyles, a retired couple has a one-in-three chance of one of them living to age 95.

For the average retiree, that is over three decades of living expenses, medical care, and unexpected emergencies that need to be funded by their pensions and investment assets. From experience, the typical retiree vastly underestimates the risk that this poses to them in their quest to remain financially independent. The investment decisions they will need to make to provide for this period will require them to put aside other fears, such as the innate fear of market declines, to give them the best chance of success.

The goal is three decades of a rising, inflation-cancelling income. The risk is that they focus on short-term fears that disadvantage them in the long term.

A Changing Landscape

The shift in focus that increasing longevity brings into play will impact the mindsets, approaches, and rules of thumb that retirees have become used to. This stresses the importance of a comprehensive retirement income plan built on evidence and rigour.

Additionally, those who are still firmly in the “savings stage” will need to adjust their expectations for what the appropriate amount is to save for their future selves. It’s a changing world, and no one is safe from the need to adapt.

As the world continues to evolve in various ways, we encourage you to consider how this impacts the way you are providing for your own future. Our financial planning philosophy will always emphasise regular reviews, and in this way we hope to make sure that our clients are always prepared for changes that others are yet to identify. We look forward to working with you in preparing for a longer future.

Contact us today, free of any obligation or commitment by clicking here

Follow us on LinkedIn for industry insights, updates and our latest news.