Longevity and The 100 Year Life

With the global population reaching 8 billion on 15 November 2022, we thought it was a fitting time to revisit an article our Managing Director, Colm Moore, contributed to the December 2021 edition of the Irish Pharmacy News journal.

In the article, Colm explores the impact increases in longevity, life expectancy, and the concept of the 100 year life have on financial planning and how you look at your retirement.

A wonderful newly colourised image I came across recently of a pharmacy located on the Quay in Waterford called Jones Chemist Shop from 1907 started a discussion about longevity, life expectancy, and how these variables have changed since that picture was taken.

Back in 1907, the average life expectancy was around 55 years with females as always in these statistics at the upper end.

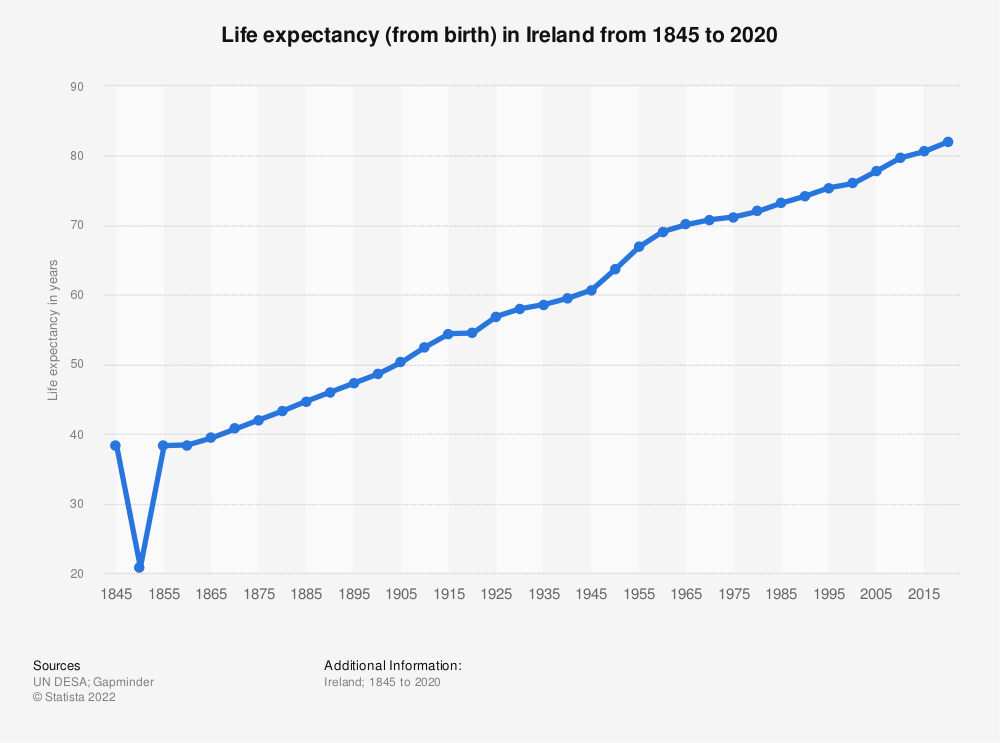

Life Expectancy in Ireland 1845-2020

You will see from the life expectancy chart as you would expect a constant upward trend with the obvious outliers of the famine and slight leveling during both world wars. This progression is due to medical advances, healthier lifestyles, and people being more proactive in relation to their own health.

This is of course all good news and should be celebrated and embraced. For the first time in history in there are more people aged over 65 than under 5 and between now and 2050 those aged 65 + will increase by 181%, those aged 85+ will increase by 351% and those aged 100+ will increase by 1004%.

This has a significant impact on financial planning and how you look at your retirement.

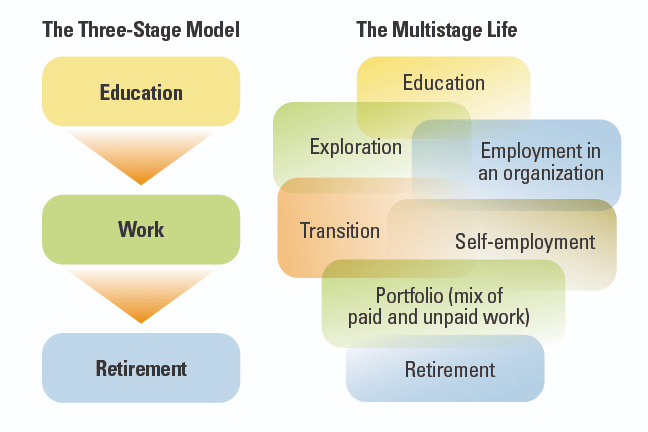

I recently attended an excellent seminar hosted by Andrew J Scott who is a Professor of Economics at The London Business School and writes extensively on aging and co-authored the influential ‘100 Year Life’. In this, he shows how the standard ideal of the three phases model of education, working life, and retirement is no longer the model to work from when creating financial plans for clients’ futures.

The new understanding which is more relevant to today is the multistage life outlined below.

Here you see a life cycle that resonates more with modern life from exploration after college to various types of employment to retirement. Crucially when you reach retirement age the potential for a longer life expectancy now needs to be factored in. This is where proper financial planning takes place.

Professor Scott believes 70 is the new 60 and it would appear this is where the government is heading with pension eligibility criteria. This has implications for pension planning as advisers can factor in a longer working life and this in turn alters the risk and return equation.

The only sure-fire method in my view to determining if you are set up for a longer active life in retirement is by talking with a Certified Financial Planning Professional ™ who runs full cash flow modelling that allows you to map out your retirement scenarios including longevity calculations. By engaging these services you are ensuring you are getting the best in class financial planning advice.

The Benefits of Cash Flow Modelling

- Easy to understand visual plans of your financial future.

- Gives you context and outcomes so informed choices can be made.

- Retirement funding shortfalls are highlighted.

- Allows you to map out different scenarios.

- Becomes a vital tool in estate planning.

- Crucially it gives you peace of mind.

All of the above are vital but the final benefit where clients walk away with the peace of mind of knowing they are on the right path is the most important one for them.

Being able to explain and quantify to a client that based on the information available they can have their dream home in the sun, put their children through college or be able to spend time with their grandchildren are the crucial outputs they want to see.

Reviewing your Finances

Many of our pharmacy clients refocus on personal finances in January after the hustle and bustle of the Christmas period when they find they have a moment or two to spare.

If you are considering looking at your overall financial status here is what you should be looking for.

Before you look forward you need to look back and see if your current setup is fit for purpose. Projections for the future are useless without making sure the proper protection is in place so any review should lead with protection and then move into pensions and investments.

The main components of a review should include an analysis of the following;

Life Cover

First, you look at what you need for family and loan protection. There are methods to quantify this and one of the most accurate is to map out the impact of the death of either spouse on future cashflows for a defined period which can be to the point for example where any children are through college and independent.

Business Protection

Business protection has a similar methodology in that you quantify the impact of the death of the business owner and insure accordingly. But what you need to understand is that if the company pays the premium in the event of a claim, the policy proceeds are paid into the business and not directly to your family.

Living Benefits

There should be a clear distinction between life cover (death protection) and living benefits which are income protection are serious illnesses.

Without a doubt, income protection is the most important cover you can have. Your ability to earn is one of your most valuable unrecognised assets and a culmination of years of hard work, study, and determination on your part, and needs to be covered. These policies are designed to pay out if you cannot work in your own occupation.

Pension

This section has to have a performance and cost review accompanied by cashflow modelling that shows the future projections of your pension and the drawdown scenarios when you reach retirement age.

Your pension is a supremely tax-efficient tool for wealth accumulation and cash extraction from a business. It is one asset in your retirement armory and needs to be overlayed with your other assets and income streams to give you a model of retirement and how best to draw cash.

It can make perfect sense to use resources such as the proceeds of a business sale first and allow your pension assets to continue to grow in a tax-free bubble until needed.

Investments and Savings

This should look at how you are investing personally held funds and determine if you are optimising the most tax-efficient environment for them.

Most personally held investments in Ireland suffer from a 1% entry levy, 1-2% annual management charge, and 41% tax on gains. This is a tough regime under which to make returns.

Options do exist for clients to invest under Capital Gains Tax which removes the 1% entry fee, reduces the annual charge and the tax on gains is at 33% after your annual CGT exemption of €1,270. This is an area that those who have recently profited from the sale of United Drug Shares should be aware of.

This is also the section of the report that ties into inheritance tax planning and it should be quantified if you should be accumulating assets in your children’s names.

Inheritance Tax Planning

An often overlooked but key piece of financial planning. This is not on most people’s radar but when you realise €335,000 per child is the inheritance tax threshold the problem comes into focus. Only on calculating the combined value of your home, business, pension, and investment assets do you realise that everything above €670,000 (two children), €1,005,000 (three children), etc are going to be taxed at 33%, that the problem becomes stark and quantifiable.

Most pharmacy owners will have businesses valued above this before factoring in other assets.

There are innovative solutions in the marketplace for this including one of the more groundbreaking polices ever launched in Ireland.

This policy insures both spouses for the inheritance tax liability. On death, the cover amount is received by the estate tax-free for settlement of the bill thus leaving all the assets in the children’s names.

The remarkable part of this policy is that after 16 years if you have not used the policy you are guaranteed that 70% of the premiums paid are returned to you. This is not conditional on anything other than you deciding you want to end the policy.

This life cover can protect your family from a substantial tax bill in the medium term while giving you time to plan for alternative ways to reduce the liability.

Longevity is on an upward curve which means you need to make sure your financial plan takes account of this. Detailed cashflow projections are now the minimum you should accept from your adviser. Don’t settle for anything else.

Colm Moore is a CERTIFIED FINANCIAL PLANNER™ with Moore Wealth Management.

MWM has been advising pharmacists for over 20 years. For more see www.mwm.ie.

Check out some of our other articles here and follow us on LinkedIn for more great content.