Significant Pension Changes in Finance Act 2022 – What You Need to Know

Written by Colm Moore, a CERTIFIED FINANCIAL PLANNER™ with Moore Wealth Management, for the Irish Pharmacy News Journal

Signed into law by President Michael D Higgins in early January this year The Finance Act 2022 brought into effect the single biggest change to pension legislation in Ireland for 30 years and this has barely got a mention outside of adviser circles.

Finance Act 2022

In recent months we wrote how the pensions authority of Ireland in the middle of a pension funding crisis stopped the establishment of company-paid pensions for business owners owing to the implementation of the IORPS II directive from Europe. This was followed by communication from the Central Bank who advised brokers not to set up any pensions for clients between June and December last year unless we were certain we knew what changes the unpublished and unwritten Finance Act would bring!

The establishment of The Master Trust Pension to replace company pensions was warmly welcomed in December and once again we could offer solutions to clients that in reality look very similar to before apart from the removal of surrender penalties and a circa 1 basis point increase in fees to cover the cost of auditing each scheme annually (an IORPs requirement). There was also the promise that legislation governing PRSAs would be updated to make them more attractive and in particular, remove the Benefit in Kind implications for employer contributions.

On publication Section 22 of the Act removes the provision which deemed an employer PRSA contribution to be an employee PRSA contribution for income tax relief purposes. However, the way they did this also created a significant opportunity that goes against all revenue practice regarding pension funding for the last 30 years.

Previously as you may be aware when a customer set up a pension the adviser runs what is called a revenue maximum funding calculation to determine what they can contribute to a pension based on the following factors:

- Age

- Selected retirement age

- Current salary

- Service with the employer to date

- The value of any existing pensions

For a real-world example take a client age 55 who has a pension valued at €750,000 and a salary of €50,000 with the business sitting on significant cash and is considering retirement. Under current revenue funding rules the maximum that the client could put in his pension is ¤19,666 per annum up to his retirement age of 65.

The Planning Opportunity

The significant change to the Finance Act is that none of the above factors(age, salary, service etc) are now factored in. There is no funding calculation for an employer contribution to a PRSA.

In the above scenario the individual if they wanted could now fund a PRSA to the maximum tax-efficient pension of €2.15m which is of course a huge increase from the current allowance. Under the new rules, this person has gone from a scenario where they could fund €196,660 into a pension to one where they can contribute €1.4m to a PRSA.

If you change the above scenario to someone who already has the maximum funded pension and has a spouse employed in the business on a nominal salary and who has none or very little pension funding to date they can under the new rules contribute up to €2.15m into a PRSA for them.

As you will see there is a significant opportunity here for cash extraction in several different scenarios that we have not seen before. This will be particularly attractive to those who are sitting on cash reserves and

- Have an underfunded pension and do not run a high salary so cannot contribute any additional funds

- Have a maxed-out pension but also have a spouse employed on a small salary who previously could only contribute a small amount

- Those close to business exit looking to extract cash tax efficiently.

There is no consensus as to whether this was the intention of the changes, yet when the initial draft of the Finance Act was announced in Oct 22 this was immediately highlighted as the situation. The view was that when the final draft arrived in early January that this would be amended or removed. However, it was not and the Department of Finance know the implications. To get this changed again would require another statutory instrument which means this is likely in place for this year at least.

As I mentioned above this is a change from revenue practice and it is the current situation at least for this year and anyone availing of it is following the legislation as written. Chief among any concerns about the interpretation of the legislation would be Revenue’s view on the implementation and this needs to be factored into any decision made and be a part of the conversation with your accountant and tax adviser.

There are of course many more variables to factor into someone putting such a lump sum into their pension and clients need to be advised accordingly to ensure this is the right course of action for their circumstances. This is where holistic advice by a CERTIFIED FINANCIAL PLANNER™ can prove invaluable and in conjunction with a lifetime cashflow model, there is an opportunity here to look at an earlier and more efficient exit from your business than you thought possible.

Wealth Demographics Report Ireland 2023

One of the benefits of being a CERTIFIED FINANCIAL PLANNER™ is access to research not available outside of the small proportion of advisers in Ireland operating at this level. Recently a report was commissioned by the Financial Planning Standard Board of Ireland entitled Wealth Demographics and the Planning Landscape in Ireland that has provided great insight into the market now and in the future.

This highlighted the robust shape of the Irish economy along with the fact we had the third highest life expectancy in Europe after Norway and Iceland with an average expectancy of 20.7 years for those retiring at age 65. Those with a more proactive approach and better access to healthcare will skew these statistics on the upside which must be factored into your financial planning and longevity calculations.

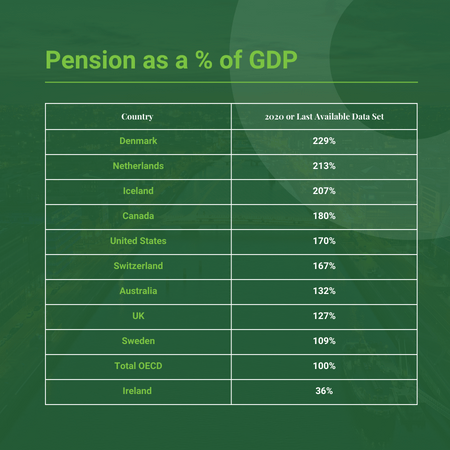

The report highlighted the large deficit in pension coverage in Ireland compared to other countries as a percentage of GDP.

Auto Enrolment of which we have expressed concerns about before will as predicted at the time of writing miss the self imposed 2024 deadline. This will help with the deficit when introduced but needs change before it even starts. I don’t think as the owners of small businesses reading this there will be any disappointment that the administrative and extra financial burden this will eventually bring is pushed own the line.

Of course, housing came up in the report as an issue and the estimates are that 700,000 new households will be formed between now and 2040 highlighting the task ahead in providing accommodation for those seeking it. One figure, in particular, jumps out and that is the difference in lifetime wealth between those who can afford to get on the property ladder and those who can’t.

When you factor in a lifetime of paying rent and not having an asset growing in your name the difference is estimated at a staggering €1.4m. This will lead to questions about inequality and a lack of fairness in the situation now that we can quantify the impact.

I’m often asked what is the best saving or investment you can make for children to provide for their future. After a good education, the figures show a strong case for making sure they can afford a home. This could be in the form of a loan from the bank of mum and dad or the gift of a cash sum to enable them to afford the deposit which can be an obstacle to those spending a vast portion of net earnings on ever-increasing rents if they can find accommodation in the first place.

This assistance to your child has the potential to become intergenerational with the hope they could then do the same for their children. How you accumulate these funds needs advice as they could come from accumulated savings, business exit, a targeted savings contract or tax-free lump sums from your pension. Again the services of an adviser who can quantify that you have what you need to enjoy your retirement before you consider this is vital and the decision must be made in the context of your circumstances.

Colm Moore is a CERTIFIED FINANCIAL PLANNER™ with Moore Wealth Management.

MWM has been advising pharmacists for over 20 years. For more see www.mwm.ie.

Check out some of our other articles here and follow us on LinkedIn for more great content.