Changes Made to Pension Planning: Kieran Moore’s Contribution to the Irish Pharmacy News

Our very own, Kieran Moore, Director of Moore Wealth Management, recently contributed a detailed overview in the latest publication of Irish Pharmacy News, on the changes made to the process of pension simplification and insight into tax on pensions and pension planning, and Auto-Enrolment for 2026.

The Key Points to Note About The Changes Made

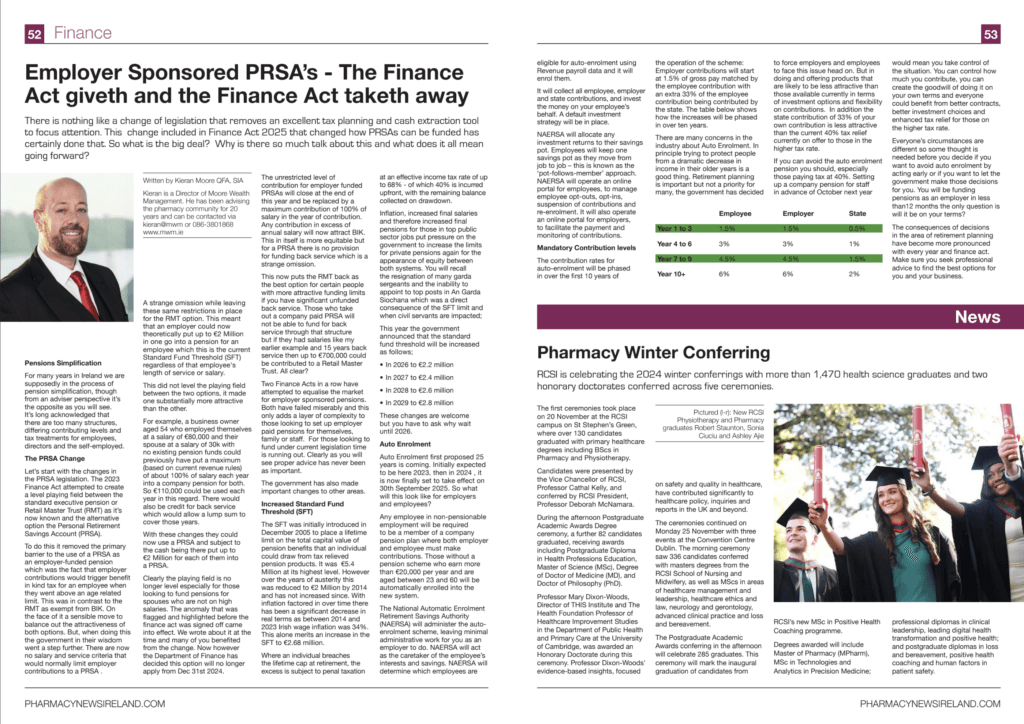

The PRSA Change

Changes made to the PRSA legislation were brought in 2023 to attempt to create a level playing field between standard executive pensions or Retail Master Trust (RMT) and the Personal Retirement Savings Account.

To do this it removed the primary barrier to the use of a PRSA as an employer-funded pension which was the fact that employer contributions would trigger benefit in-kind tax for an employee when they went above an age-related limit.

However, there are now no salary and service criteria that would normally limit employer contributions to a PRSA. This meant that an employer could now, in theory, place up to €2 Million into a pension for an employee in one go, regardless of that employee’s length of service or salary.

Now however, the Department of Finance has decided this option will no longer apply from December 31st 2024 and will be replaced by a maximum contribution of 100% of salary in the year of contribution and any excess will now attract BIK.

Increased Standard Fund Threshold

This year the government announced that the standard fund threshold will be increased due to the increase in inflation. The new Standard Fund Thresholds are as follows;

• In 2026 to €2.2 million

• In 2027 to €2.4 million

• In 2028 to €2.6 million

• In 2029 to €2.8 million

Auto Enrolment

The Auto Enrolment scheme is an initiative created by the Government in Ireland to help individuals reduce their reliance on the State pension upon retirement and is to take effect on 1st January 2026.

Those without a pension scheme who earn more than €20,000 per year and are aged between 23 and 60 will be automatically enrolled into the new system.

The National Automatic Enrolment Retirement Savings Authority (NAERSA) will administer the auto-enrolment scheme, leaving minimal administrative work for you as an employer to do.

If you are an employer or an employee who needs guidance or support on Retirement or Pension Planning or the new Pension Auto Enrolment Scheme, contact us today.

Follow us on LinkedIn to keep informed on industry insights, updates and our latest news.